Capabilities

Huntswood’s suite of client services provide the people, processes and technologies your business needs to succeed, all supported by advisory expertise

Complaints

Complaints Outlook 2024

Our latest Complaints Outlook research report provides your firm with actionable insight for every stage of the complaints journey

Industries

We help clients transform their business to drive better customer, compliance and commercial outcomes

Hunstwood

We are Huntswood

Learn more about Huntswood’s experience, high quality resource and bespoke solutions.

Stay informed. Stay ahead.

Doing what’s right for the customers

Regulators across just about every sector we are engaged in have made ‘vulnerable customer’ policy a priority and will continue to do so for the foreseeable future.

Ensuring that customers in vulnerable circumstances are protected and receive fair outcomes is not just a regulatory requirement, it’s a moral duty for firms supplying essential products and services. Doing your part for vulnerable customers also leads to continued customer advocacy and loyalty among customers.

But identifying customers in vulnerable circumstances – and taking action to support them – is not a simple matter. “Vulnerability” can be a permanent state (resulting from disability, for example) but it can also be a temporary state caused by one of life’s many challenges.

A proven track record

Huntswood has a long history in delivering projects that deliver fair outcomes for vulnerable customers. Our advisory expertise and operational finesse allow us to ensure that all of your customers receive the best service possible.

Huntswood can help your firm write the policies and governance strategy that underpin your approach to supporting customers in vulnerable circumstances. We then embed the systems and resource needed to monitor, respond to and protect those who most need it.

Affordability and responsible lending

Getting the balance right and ensuring you are delivering the best possible outcomes for your business and your customers

Remote working

In today’s world, it is imperative that businesses are able to operate remotely. We provide clients with remote resource solutions that are optimised and secure without sacrificing operational excellence.

Self-assessment

How does your firm stack up to the industry average? Are you delivering fair outcomes? How would you rate your ability to detect signs of vulnerability?

Use the Huntswood self-assessment tool to benchmark your firm’s performance today. It’s free, secure and simple to complete.

Vulnerability framework

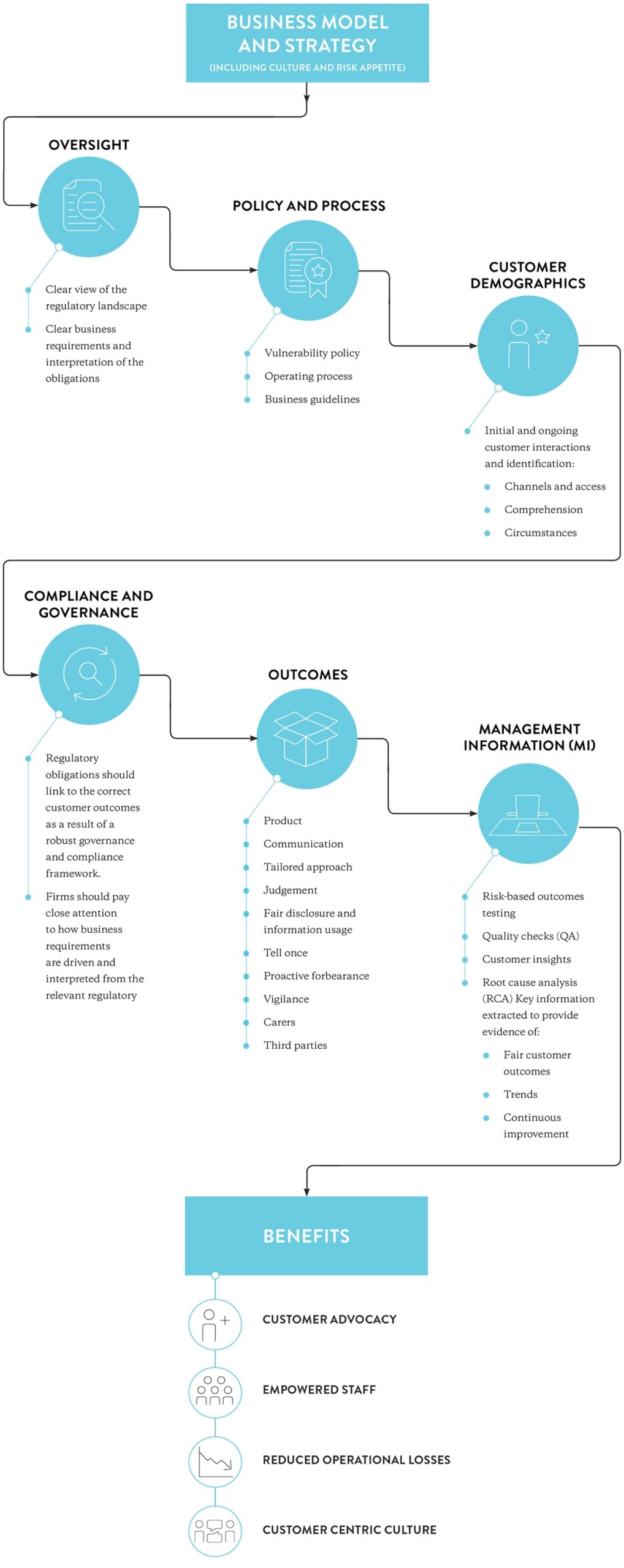

Firms must ask themselves how they will ensure effective delivery of suitable outcomes in a way that engages senior management, is aligned to strategy, culture and business model, is tailored to the firm’s customers and ensures that the key benefits are delivered.

We can provide assurance on your firm’s vulnerability framework, and even support in the creation of a whole new strategy that will be fit-for-purpose for years to come.

Fair treatment of customers in vulnerable circumstances

Improve the way your firm handles customer vulnerability

Latest insights

Sign up for regular insights

Keeping up-to-date with the latest industry topics and regulatory issues can be quite time-consuming!

Thankfully, our regulatory experts are here to help you stay on top of it all. Fill in the short form below to receive a monthly round-up of our insight, news and analysis.